Why $445M Couldn't Save Builder.ai

Builder.ai raised $445 million.

They had world-class talent. They built a real product. They executed on their vision.

Then they went bankrupt in May 2025.

The scary part? They didn't fail because of bad timing. They didn't fail because competitors crushed them. They didn't fail because they ran out of money.

They failed because they built something nobody wanted.

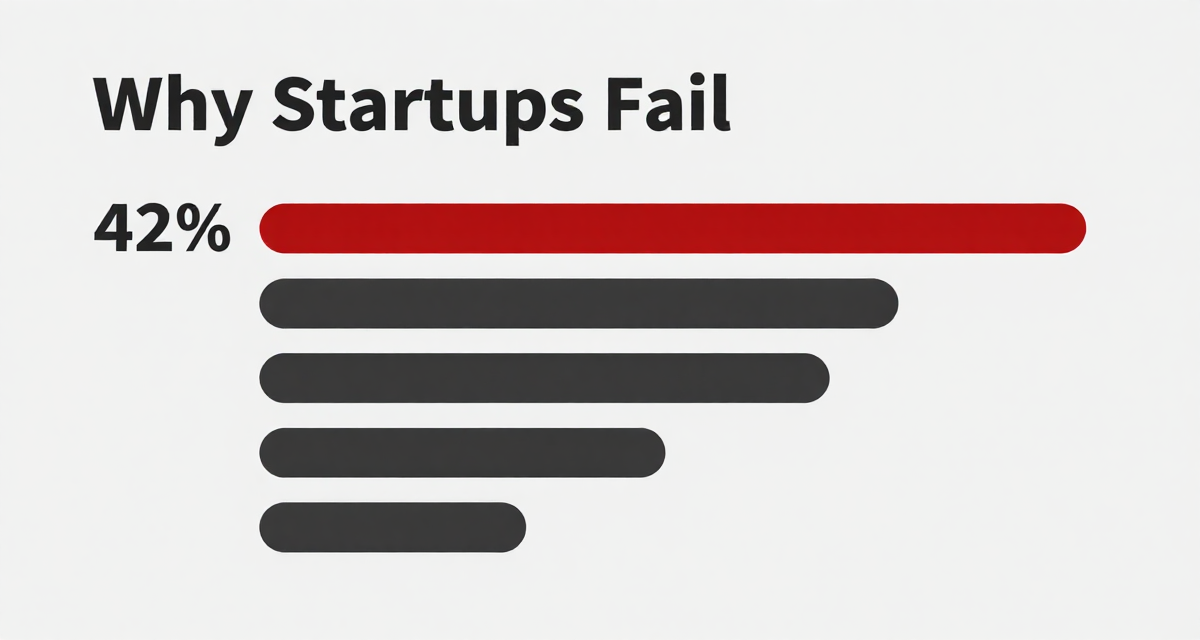

This is the most common way startups die. It's responsible for 42% of all failures. That's more than double the next cause.

Here's how it happens, how to spot it, and how to not be the next Builder.ai.

Why Startups Fail (CB Insights)

42% of startups fail because nobody wants what they built

* Percentages do not sum to 100 because failures have multiple causes

Forty-two percent.

Almost half of all startup deaths are preventable. They happen because founders build solutions without confirming there's a problem.

The pattern is so consistent that you can set your watch by it:

I've seen this play out dozens of times. The founders aren't stupid. They're capable. They work hard.

They're just answering the wrong question.

They ask: "Can I build this?"

Instead of: "Does anyone want this?"

The Death Spiral: How It Happens

It doesn't happen overnight. It's a slow decline with three distinct stages.

Stage 1: The Vision Problem

It starts with a story founders tell themselves.

"I'm going to disrupt [industry]."

"We're building Uber for [blank]."

"This market is huge, if we capture just 1%..."

Notice what's missing. Any mention of actual customers. Any mention of real problems humans face. Any evidence that the world wants what they're selling.

At this stage, the company has energy. The founder is charismatic. The vision sounds compelling. Investors might even be interested.

But the foundation is cracked. You can't build a stable house on a cracked foundation.

Stage 2: The Funding Trap

This is where things get dangerous.

The startup raises money. Maybe a lot of it. Now they have runway. They hire. They build. They launch.

The trap: money masks the lack of market need.

If you have $10M in the bank, you can survive for years without a real business. You can fake growth with paid marketing. You can hire a PR firm to get press coverage. You can convince yourself things are working because your vanity metrics look good.

But underneath, the fundamental problem remains. People don't want what you're selling. Not enough of them, not enough to sustain a business.

Stage 3: The Reality Check

Eventually reality wins.

The money runs out. The paid marketing can't be justified. The press stops caring. The investors stop returning calls.

And the founder faces the truth: they spent years building something nobody wanted.

This is the hardest moment in a founder's life. I've been there. It's brutal. It hurts. It feels like failure.

But it's not failure. It's data. Painful, expensive data.

Case Study: Builder.ai

What actually happened.

Builder.ai: The Death Spiral

$445 million raised, then gone. Here is how it happened.

Launched as "AI-powered" app development platform

Raised $200M+ across multiple rounds

Hired hundreds, scaled operations aggressively

Revenue missed projections, "AI" claims questioned

Filed for bankruptcy after burning through $445M

Money masks lack of product-market fit until it does not.

Builder.ai was supposed to revolutionize app development. Their pitch: AI that builds software automatically. No developers needed. Just describe what you want, and their system generates it.

Investors bought it. $445 million worth of belief.

The problem? The "AI" wasn't really AI. Much of it was human labor dressed up as automation. The product was complex, expensive, and solved a problem that wasn't actually a problem.

Developers didn't want it - they already knew how to code. Non-developers didn't want it either - app development wasn't their bottleneck.

The product was technically impressive. It just wasn't something the market needed.

When the money ran out, there was no business to sustain it.

Case Study: Element AI

Similar story, different outcome.

Element AI raised over $200 million. Founded by AI pioneers including Yoshua Bengio, one of the godfathers of deep learning. World-class talent. Massive resources.

Sold for $230 million.

That sounds like an exit until you realize they raised more than they sold for. The investors lost money. The team that spent years building got scattered.

What went wrong? They never found product-market fit. They pivoted constantly. One month it was AI consulting. The next it was specialized tools. Then back to consulting.

They had incredible AI capabilities. They just couldn't figure out what businesses would pay for.

Real Validation: What It Looks Like

Validation isn't a landing page that collects emails. Validation isn't your mom saying "that sounds cool." Validation isn't fake door tests that trick people into clicking.

Real validation answers one question: Will people pay for this?

Real Validation vs Fake Validation

Money is the only vote that counts.

Someone paying you before you build. The only test that matters.

Not surveys. Actual conversations where you listen more than talk.

Put something in hands. Watch them use it. If they can not stop talking, you are good.

Better than nothing, but email signups don not equal paying customers.

Tricking people into clicking does not prove they will pay.

Friends are biased. They want you to feel good. Find strangers.

Press does not equal revenue. Many hyped products fail.

What actually works, ranked from most reliable to least:

Pre-sales. If someone gives you money before you build, you've validated. Period. This is the only test that matters.

Customer deposits. Same as pre-sales but with a commitment timeline. Still real money, still real validation.

20 real conversations. Not surveys. Not "would you use this." Actual conversations where you listen more than you talk. If 15 people say "I have this problem and I'd pay to solve it," you're on to something.

Prototype testing. Put something in people's hands. Watch them use it. If they can't stop talking about it, you're good. If they're polite but not excited, keep searching.

What doesn't work: Fake door tests that trick people, surveys that don't reveal actual behavior, friends saying "that's interesting," press coverage, social media followers, investor interest.

None of those correlate with revenue. Validation that doesn't prove revenue potential isn't validation.

Warning Signs You're Building The Wrong Thing

5 Warning Signs You Are Building the Wrong Thing

Spot these early, pivot or persevere accordingly.

Cannot Explain Problem in One Sentence

If it takes three paragraphs, you do not understand the problem yet. Go back to customer conversations.

Your "Validation" Was Friends Saying "Cool"

Friends are not customers. They are biased. They want you to feel good. Find strangers.

Building for Technical Interest

That is a hobby, not a business. Hobbies are great. Just do not quit your day job.

No One Has Paid You Anything

This is the biggest red flag. Money is the only vote that counts. If you have not gotten someone to pay, you have not validated.

Focused on Competitors, Not Customers

Competitors do not matter if you have product-market fit. If you are obsessed with competition, you are probably not obsessed enough with customers.

The good news: Avoiding this trap is straightforward. Talk to customers before you build. Get them to pay before you scale. Validate the problem exists before you invest in the solution.

You can't explain the problem in one sentence.

If it takes you three paragraphs to explain what problem you're solving, you don't understand the problem yet. Go back to customer conversations.

Your "validation" was friends saying "that's cool."

Friends are not your customers. They're biased. They want you to feel good. Find strangers.

You're building because it's technically interesting.

That's a hobby, not a business. Hobbies are great. Just don't quit your day job.

No one has paid you anything.

This is the biggest red flag. Money is the only vote that counts. If you haven't gotten someone to open their wallet, you haven't validated anything.

You're focused on competitors, not customers.

Competitors don't matter if you have product-market fit. Facebook wasn't the first social network. Google wasn't the first search engine. If you're obsessed with competitors, you're probably not obsessed enough with customers.

When to Pivot vs When to Persevere

The hardest question in startups. A simple framework:

Pivot if:

- •You can't find 10 people who have the problem you're solving

- •People use your product but don't come back

- •Users say they'd pay if you added [feature], but they won't pay for what you have now

- •You've been at it for 6 months with a viable product and growth is still flat

Persevere if:

- •Users are engaged but revenue growth is slow

- •People complain when things break

- •You're seeing word-of-mouth growth

- •You have paying customers who renew

The difference comes down to one question: Are you solving a real problem that people will pay to solve?

If yes, persevere. If no, pivot.

You Can Avoid This

The founders of Builder.ai and Element AI aren't stupid. They're smart, capable people who fell into a trap.

The trap is believing that building something great is enough.

It's not. You have to build something great that people actually want.

The good news: avoiding this trap is straightforward. Talk to customers before you build. Get them to pay before you scale. Validate the problem exists before you invest in the solution.

It's not glamorous. It won't get you on the cover of TechCrunch. But it works.

Not Sure If You're Building The Right Thing?

You don't have to guess.

Before you spend months building, spend weeks validating. Before you quit your job, prove there's a business there. Before you raise money, show customers will pay.

We help founders figure this out every day. Not through meetings and slide decks. Through real conversations about your product, your market, and whether there's a match.

Get an honest assessment. Takes 5 minutes. No calls required.

Or go validate the old-fashioned way. Talk to 20 customers. Just don't skip it.

This post is part of our series for startup founders. We write about MVP development, product validation, and building things people actually want.

Ready to build your project?

Get a transparent estimate in minutes. No calls required.

Get Your Estimate →